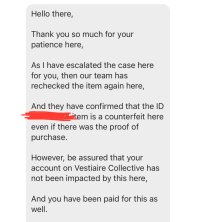

What brand was it?Omg, it’s just getting funnier and funnier… Here’s the response I’ve got after requesting the reason of declaring the bag a “fake”:

The item was counterfeit, because

**Counterfeit**

----------

- Packaging not conforming to the brand: dustbag

- Non-quality materials: low-quality grained leather

- Typography not consistent with the era

- Metal parts not conforming

- Engravings with defects

- Typography non-conforming on the metal parts of the shoulder strap

- Shape of the clasp not conforming.

What “era” are they even talking about??? It’s a contemporary designer bag (under €1000), purchased just last year via LUISAVIAROMA!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Vestiaire Collective experiences?

- Thread starter Kopisusu

- Start date

TPF may earn a commission from merchant affiliate

links, including eBay, Amazon, and others

More options

Who Replied?I’ve just deleted my account. My last thoughts are, it WAS a reasonable company. I found their customer service very good. Then all of a sudden it just started to go downhill. Customer service agents used word salad or repetition to avoid addressing and answering your questions. Direct shipping? Avoid, they use it in any counterfeit claim ‘I note you used Direct Shipping……..’ oh dear. There are bargains to be had but never ever buy via Direct Shipping or a brand you are not well informed about. Good luck all.

That’s good to hear. I’ve had great bargains in the past. 👍I have only bought 2 Bals there, but my experiences have been good.

Just bought 2 ferragamos from a seller. 2500 euros for both. Why sellers say they ship immideately after purchase and then ghosting...okay I bought it yesterday, but since then no update.

They do have 5-7 days to post. Ghosting could just be ignoring ie can’t be bothered. It’s annoying but 🤷♀️ keep on top of it though 🤞Just bought 2 ferragamos from a seller. 2500 euros for both. Why sellers say they ship immideately after purchase and then ghosting...okay I bought it yesterday, but since then no update.

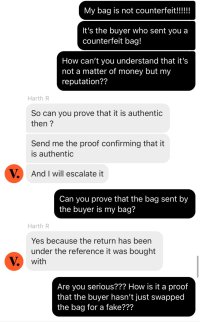

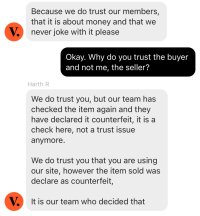

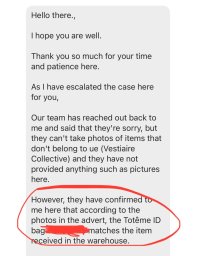

Doesn’t surprise me unfortunatelyI will just leave it here. I’m just shocked by their bizarre logic and incompetence…

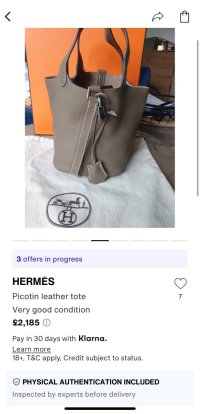

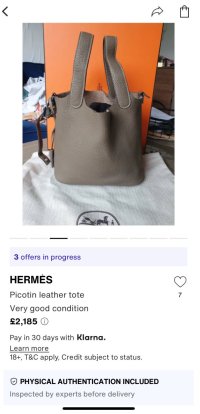

View attachment 6043377View attachment 6043378View attachment 6043379

Thanks! I had never heard of this brand. I took a Quick Look, it’s bags retailed prices around $1,000 and under. Hardly imagine any counterfeit would spend time making copies of non popular and low priced items.Toteme

Well, it actually has become quite popular in last few years, and it’s sold all over the world by reputable retailers. But I agree that it’s highly unlikely to be copied, and I really stumbled on their reasoning for it being a counterfeit due to “Typography not consistent with the era” as I posted earlier. What “era” are they even talking about for a new bag??Thanks! I had never heard of this brand. I took a Quick Look, it’s bags retailed prices around $1,000 and under. Hardly imagine any counterfeit would spend time making copies of non popular and low priced items.

But most shocking of course is that they trust the buyer who sends them back the bag after OVER HALF A YEAR and not their expert seller, who has a history of selling quite expensive authentic luxury items! And their only reason to believe the buyer is the fact that she sent the bag under the reference it was bought with

How does that prove anything???

How does that prove anything???And taking into consideration their extensive list of reasons “proving that the bag is fake” which I posted earlier, wouldn’t it be suspicious for them that the buyer, upon receiving the bag, wouldn’t be shocked by how different it was from my photos, and contacted them about it directly instead of waiting for 8 months??

Last edited:

I have bought 2 bags from here and the experience was good...they also are constantly having coupons/% off deals.

No experience selling on there although would like to try but kind of scared to based on some experiences read on here lol

No experience selling on there although would like to try but kind of scared to based on some experiences read on here lol

Hi, I’m new on here and wasn’t sure where to post this. Has anyone had any experiences purchasing from HEWI (hardly everwornit), I’m looking at a bag on there and just want to make sure that it’s 100% legit! Thanks!

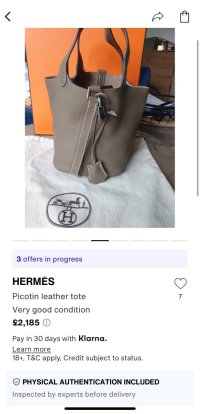

Not sure what’s happening here but this is extremely low quality fake with major inaccuracies. And it passed the verification. Vestiaire has zero interest in their reputation.

www.vestiairecollective.com

www.vestiairecollective.com

Hermes Handbag - Our collection of second hand bags - Vestiaire Collective

Browse our ample selection of Hermès handbags, from Kelly and Birkin styles to classic flap bags. Every piece is crafted with luxurious materials such as Epsom leather, chevre hide, gold hardware and palladium. Questions? Contact us today!

Register on TPF! This sidebar then disappears and there are less ads!