Thank you. This is great! The net profit(including PM 20% commission, taxes, shipping) is $75,000. I will try to find all of my receipts to see which one's I made a loss and profit on. I will then submit those to my accountant. I will just use Turbotax next year. This is such a pain. I really appreciate all of your great advice.According to your accountant, you could focus on your net profit now, such as say

You total sale was $75,000, if you made net profit of $10,000, go find records of that $10,000 and summit, if was total loss, then gave a figure of your loss is such as say -$15,000 after your calculation and summit.

TurboTax cost about $80 to $100

Your biggest obstacle right now I think is time, you may not have that much time to find a new trustworthy reliable accountant to do the amendment, you have a few days to try then decide.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Does anyone use Poshmark?

- Thread starter kenzibray

- Start date

TPF may earn a commission from merchant affiliate

links, including eBay, Amazon, and others

More options

Who Replied?You are very welcome, I hope everything will be solved smoothly, please keep us updated 😘Thank you. This is great! The net profit(including PM 20% commission, taxes, shipping) is $75,000. I will try to find all of my receipts to see which one's I made a loss and profit on. I will then submit those to my accountant. I will just use Turbotax next year. This is such a pain. I really appreciate all of your great advice.

I updated my reply with more information. Please look at it.No, I have never filed a schedule D. I don't know if my accountant was going to plan on filing this one as an amended return or not?

You don't have a choice. You have to file an amended return if you've already filed.

Thank you! I will keep everyone update. I'm so thankful for this forum!You are very welcome, I hope everything will be solved smoothly, please keep us updated 😘

Thank you!! I really appreciate your help.I updated my reply with more information. Please look at it.

You don't have a choice. You have to file an amended return if you've already filed.

What to do with Form 1099-K | Internal Revenue Service

Use Form 1099-K with your other records to help figure and report your correct income on your tax return. Find out what to do if the form is incorrect or if you shouldn’t have received it.

Thank you!!!!From IRS website:

Personal items sold at a loss

A loss on the sale of a personal item can't be deducted from your taxes. But you can zero out the reported gross income so you don't pay taxes on it.

If you sold personal items at a loss, you have 2 options to report the loss:

Report on Schedule 1 (Form 1040)

You can report and then zero out the Form 1099-K gross payment amount on Schedule 1 (Form 1040), Additional Income and Adjustments to IncomePDF.

Example: You receive a Form 1099-K that includes the sale of your car online for $21,000, which is less than you paid for it.

On Schedule 1 (Form 1040):

These 2 entries result in a $0 net effect on your adjusted gross income (AGI).

- Enter the Form 1099-K gross payment amount (Box 1a) on Part I – Line 8z – Other Income: "Form 1099-K Personal Item Sold at a Loss, $21,000"

- Offset the Form 1099-K gross payment amount (Box 1a) on Part II – Line 24z – Other Adjustments: "Form 1099-K Personal Item Sold at a Loss $21,000"

Report on Form 8949

You can also report the loss on Form 8949, Sales and Other Dispositions of Capital Assets, which carries to Schedule D, Capital Gains and Losses.

Back to top

Personal items sold at a gain

If you made a profit or gain on the sale of a personal item, your profit is taxable. The profit is the difference between the amount you received for selling the item and the amount you originally paid for the item.

If you receive a Form 1099-K for a personal item sold at a gain, figure and report the gain on both:

You are welcome, I believe there are tons of people have trouble to fill those forms properly 😘Thank you!!!!

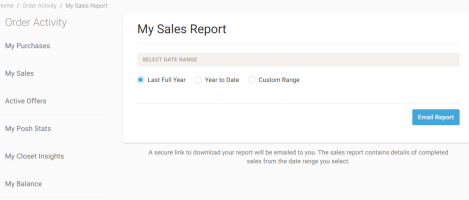

I recommend to download your sales report on Poshmark in Sales section.Thank you. This is great! The net profit(including PM 20% commission, taxes, shipping) is $75,000. I will try to find all of my receipts to see which one's I made a loss and profit on. I will then submit those to my accountant. I will just use Turbotax next year. This is such a pain. I really appreciate all of your great advice.

For the next year it will make it much easier if you put purchase price in the listing (in the private area where only you can see it). Then you can download the annual sales report that already includes the costs, you will only need to do math if it was profit or loss.

I am confused. Didn’t you post earlier that most items sold at a loss? How does someone selling clothes from her closet at a loss get to a net profit of $75,000? Did you make a massive profit on one or two items or did you mean to write that your gross sales reported on the 1099k form are $75,000?Thank you. This is great! The net profit(including PM 20% commission, taxes, shipping) is $75,000. I will try to find all of my receipts to see which one's I made a loss and profit on. I will then submit those to my accountant. I will just use Turbotax next year. This is such a pain. I really appreciate all of your great advice.

This might be helpful:

Guides: How to File Your Poshmark Taxes

Poshmark Seller Tax Guide: Learn how to classify your sales, which tax forms to use, and maximize deductions to save money.

That article is not helping, it says if it's not business you can't subtract expenses including Poshmark fees. That's misinformation. Even Poshmark explained that you are not paying taxes on total reported sales, only on your withdrawals after the fees. and then it depends which form to use if it was a profit or loss.I am confused. Didn’t you post earlier that most items sold at a loss? How does someone selling clothes from her closet at a loss get to a net profit of $75,000? Did you make a massive profit on one or two items or did you mean to write that your gross sales reported on the 1099k form are $75,000?

This might be helpful:

Guides: How to File Your Poshmark Taxes

Poshmark Seller Tax Guide: Learn how to classify your sales, which tax forms to use, and maximize deductions to save money.found.com

You read that article more carefully than I did.That article is not helping, it says if it's not business you can't subtract expenses including Poshmark fees. That's misinformation. Even Poshmark explained that you are not paying taxes on total reported sales, only on your withdrawals after the fees. and then it depends which form to use if it was a profit or loss.

I stand by my original question which is: how does an individual selling clothes from her closet—with most sold at a LOSS—get to $75,000 NET PROFIT? I am asking for clarification on whether OP meant $75,000 GROSS SALES or $75,000 NET PROFIT. Big difference.

If you read her previous posts you probably would see it was typo, she meant $75,000 gross sale and she mostly sold her items at big loss such as $750 jacket sold at $350, at least to my understanding she took losses to get rid off things.You read that article more carefully than I did.

I stand by my original question which is: how does an individual selling clothes from her closet—with most sold at a LOSS—get to $75,000 NET PROFIT? I am asking for clarification on whether OP meant $75,000 GROSS SALES or $75,000 NET PROFIT. Big difference.

Your accountant is correct. She/he has to list every single transaction as part of reporting them as a sale of personal property. It does take a lot of time to enter the information into a tax return, thus her extra charge is reasonable (trust me - I do my own taxes). The short and long term capital gains are taxed at different tax rates, so the length of time you held your items will affect your tax rate. I would suggest keeping a spreadsheet to keep track of your cost and any adjustments to your cost basis (commissions, shipping, etc) in case you are audited.I emailed my accountant and this is what he said "

"we can report it on Schedule D. But there are two things you must consider."

What do you think I should do? Again, I already paid him to file my 1099 and personal taxes in Feb. I paid $350 for that. Now he's saying this. It sounds like he doesn't want to do file a schedule D.

- We have to list every single item sold. If you sold 300 items, we have to list all 300 items. This would cause your tax preparation fee to increase a considerable amount because I would have to spend hours inputting all this data.

- But for your tax return, I was planning to simply report “personal items sold” instead of listing each individual piece.

- The clothing sold within a year is still taxed at your ordinary tax rate. Your Federal tax rate is 22%. Your California tax rate is 8%. This is total 30%. If your net profit is $20,000, you would owe $6,000 in taxes. Only the clothing sold over a year after purchase is taxed at the lower 15% Federal rate and 8% California.

- The IRS does not allow taxpayers to take a loss from selling personal property. Therefore, you would only be reporting the clothing sold for a net profit. I’m unsure if this would result in a larger profit."

I don't want to get audited. Should I just try to figure out how to fill out a Schedule D myself and then file it?

Reporting it on schedule C or D has adv/disadv. With schedule C, you can report it as a business and take other allowable deductions (like if you are running your resale business). You have to pay self employment tax and have to show profits for your venture to be considered a business. You might need to check with your state of residence if you need to get a resale license, etc as there are other multiple regulations that govern business activities in your state. If your sales are truly selling your personal items (some at loss, some for profit), then schedule D is most appropriate, alas more time-consuming in reporting.Do you already file a schedule D? You would use it for investments, like if you sold stock.

This is what Schedule D looks like: https://www.irs.gov/pub/irs-pdf/f1040sd.pdf

If you wanted to list each item, this is the form you would use (in addition to schedule D): https://www.irs.gov/pub/irs-pdf/f8949.pdf

See all the information that is required? Do you have all of it?

You can just file out these forms without using a tax program. Each form on the IRS website has an instructional page also.

I've only done an amended return once. It has three columns for each item. You have to put in the numbers from your original return, then put in your changes. Then you would attach your Schedule D and 8949.

Do they give you an option to do an amended return?

I think at this late date, it might be too much for you to do on your own. Personally I think doing a schedule C would be easier than schedule D and 8949, but getting advice on the internet may not be the smartest. Does the guy who is doing your taxes work for himself or for a company? If he works for a company, maybe you can ask to speak to his supervisor or someone else in the firm.

The accountant’s reply is correct - it does take a lot of time to enter all those transactions into the tax software. If you have never done it yourself, the charge seems outrageous, but it is not.

Register on TPF! This sidebar then disappears and there are less ads!