Thank you @rainbowneko for your research and really great explanations. This is a HUGE deal. Price increases having nothing to do with Chanel as we know it at all, but rather to fund other ventures is … actually for me pretty nauseating.I have an accountancy background which explained why I question chanel's way of doing business. You are right that the real intention of chanel constant price increases is to fund VC/ investment activities instead of re-investing back into chanel.

Thank you for sharing additional insights on mousse partners and their M&A activities! I found this an old article which might be helpful for others to read and understand what mousse partners involved in (if unable to access it, try to use private browser!)

How the Secretive Family Behind Chanel Is Reshaping a Big Investment Bet

Mousse Partners, the family office for one of the world’s largest fortunes, is reshaping one of its biggest bets.www.bloomberg.com

Really appreciate that many people in this thread start to question this company and provide lots of useful information!! We are here to learn from one another!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chanel’s Rise & STALL: Defects, Difficulties & Deflection (formerly the 19 tote saga thread)

- Thread starter TraceySH

- Start date

TPF may earn a commission from merchant affiliate

links, including eBay, Amazon, and others

More options

Who Replied?Insane amount of info here @ntntgo thank you. The 40k’ view w/ all the various parts (which I guess I really failed to even consider) start to complete the puzzle of why/ who/ where/ how that I’ve been struggling to understand.I’m assuming, possibly incorrectly, that you work in finance because you have a better than most understanding of financials. Not to mention access (limited or not) to UK financials.

Chanel, Mousse & definitely not Litor as my clients. I do have all 3 of the conglomerates. LVMH, Kering & Richemont. So I have to be careful trying to access the Chanel accounts. Hermes was awarded for their financial transparency so it doesn’t take much to get their annual reports.

To your point #3, you are entirely correct about sustainability. They have no transparency regarding sustainability, DE&I or an org chart, including share holders. Yes folks, there are 14 shareholders in the Chanel Ltd company and they are not all Wertheimers.

The reason they put out the 2018 annual report was because they were raising capital.

The $5 billion taken out of Chanel Ltd (yes it was strictly that company within the portfolio) was not used toward the recent purchases of green companies, healthcare (mainly Brightside Health) and their most recent, Evolved by Nature which they put $120 million into. The divestiture in Ulta was a decent sized one.

Here is a link to Crunchbase that will not require the subscription that my company has. But it will show you the huge amounts of money has been put into other companies.

The only reason I’m spending time in this thread is because I would love people to educate themselves on where their money is going and why quality subsides while prices increase.

This is the behavior of a VC that is preparing to sell off their most famous name in their portfolio.

I’d like to reiterate that these are facts, not conjecture or opinions as some have implied.

Sounds just like another banal opportunistic capitalistic conglomerate that has nothing to do with fashion/ heritage/ pride & just bleeds profits from one subsidiary to another. How… uninspiring.

Well, it might not be all leather, but it will last. And that certainly counts for something!!! I’ve been using this bag for a couple of days now in rotation and not a blemish on itAs someone who just randomly clicked on this with no clue about what this discussion is fully about. This has got to be the best bag advert I've seen. Chanel should send you a check because I've never cared about this bag until now. Now I'm like, maybe I need this bag!

And I thought it was to maintain loss making Couture and keep their Métiers Maisons afloat. I'm so naive.Thank you @rainbowneko for your research and really great explanations. This is a HUGE deal. Price increases having nothing to do with Chanel as we know it at all, but rather to fund other ventures is … actually for me pretty nauseating.

Shall be giving DH these reports to look at, as he has the right background to interpret and explain to me.

Shall be giving DH these reports to look at, as he has the right background to interpret and explain to me.

Last edited:

Hello EpiFanatic!!@rainbowneko thanks for this great info. Can you please explain again what business lines the “consolidated” f/s includes? Were separate b/s and I/s provided for each line of business to rollup to the consolidated ones? Were there footnotes to the f/s? I’d be very curious to read them. I will say I am sadly surprised at the very low COGS as a percentage of sales. But since this seems to include many different lines of business you cannot tell whether this is due to the fashion house p&l. Just not enough info here.

I just looked at Hermes f/s and if anyone is interested the p&l starts on page 40. And a few pages before that sales by region. Very interesting. Japan has its own line. Lol! But just based on the sales detail, I can clearly tell the amount of income generated by their various product lines. Interesting info. And their COGS as a percentage of sales is so much a higher than Chanel’s. WTH.

Consolidated financial statement is defined as the "financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent company and its subsidiaries are presented as those of a single economic entity". So in this case, Chanel Limited is the "middle person"/ parent, Litdor Ltd is the ultimate parent (the main owners), and the rest of the companies under Chanel Limited owns are called subsidiaries.

Due to the nature of the extremely large volume of subsidiaries, it will be hard for Chanel to come up with each balance sheet or income statement line item and tagged to the respective subsidiaries. You are right on each line of business or subsidiary are being added together and it is reflected as an aggregate amount eg. revenue in Chanel Limited consisting of all the subsidiaries, joint ventures, and associates' revenue. So Chanel Limited did include Chanel UK's revenue (which explained why Chanel UK was having only 43m Euro Dollars, while the overall Chanel Limited had 15b USD).

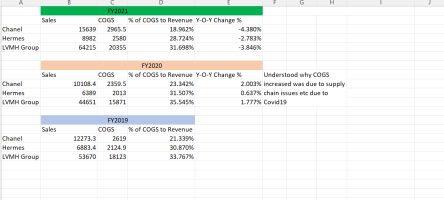

I have made a comparison between Chanel, LVMH Group and Hermes on their COGS relative to the revenue for FY2021, FY2020, and FY2019. Understand that Chanel had the most changes in % for COGS. Despite the percentage numbers are small, but actually its quite alot considering the annual report denotes millions.

Note: all 3 comparing companies used in terms of millions in their financial statements

Hope the comparison helps you guys to understand what is going on with the extent of the potential cost-cutting in COGS between pre and post covid years.

sources: Chanel Limited 2019 Report https://sec.report/lux/doc/101873535

Last edited:

I feel like i got scammed into buying the brand hahahahaWOW I feel more we dig deeper, more we don’t know about “Chanel”.

Thank you for sharing all this info…

You are just amazing to do this @rainbownekoHello EpiFanatic!!

Consolidated financial statement is defined as the "financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent company and its subsidiaries are presented as those of a single economic entity". So in this case, Chanel Limited is the "middle person"/ parent, Litdor Ltd is the ultimate parent (the main owners), and the rest of the companies under Chanel Limited owns are called subsidiaries.

Due to the nature of the extremely large volume of subsidiaries, it will be hard for Chanel to come up with each balance sheet or income statement line item and tagged to the respective subsidiaries. You are right on each line of business or subsidiary are being added together and it is reflected as an aggregate amount eg. revenue in Chanel Limited consisting of all the subsidiaries, joint ventures, and associates' revenue. So Chanel Limited did include Chanel UK's revenue (which explained why Chanel UK was having only 43m Euro Dollars, while the overall Chanel Limited had 15b USD).

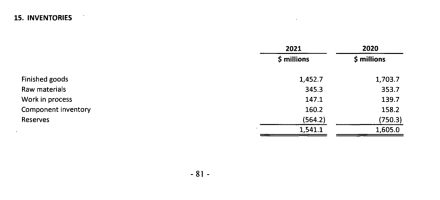

There are notes to financial statements that you can deep dive into. I also noted that the inventory value cut by half as well. This made me wondered did they managed to cut the production costs significantly or they produced lesser goods (which explains why it is so hard and competitive to get chanel bags these days), or both. View attachment 5589583

I have made a comparison between Chanel, LVMH Group and Hermes on their COGS relative to the revenue for FY2021, FY2020, and FY2019. Understand that Chanel had the most changes in % for COGS. Despite the percentage numbers are small, but actually its quite alot considering the annual report denotes millions.

Note: all 3 comparing companies used in terms of millions in their financial statements

Hope the comparison helps you guys to understand what is going on with the extent of the potential cost-cutting in COGS between pre and post covid years.

View attachment 5589592

sources: Chanel Limited 2019 Report https://sec.report/lux/doc/101873535

So back in 2019, when COVID hit, I know Chanel (or whatever “Chanel” really is) took out a loan for $500m that had all kinds of hair on it, most of it regarding sustainability pledges over the subsequent years.

Not sure bags are scarce tho. Some are limited that’s for sure. But many if not most boutiques are rife with stock. They have basements and hidden closets (not talking about the ones we all rifle through when we go in) with bags even up to a decade old. I think there’s the appearance of scarcity, but not sure it’s backed up with what I’ve seen and heard. I do know they’ve cut way way way back on RTW tho.

Will look forward to his feedback!!!And I thought it was to maintain loss making Couture and keep their Métiers Maisons afloat. I'm so naive.Shall be giving DH these reports to look at, as he has the right background to interpret and explain to me.

You're welcome! Hope my insights/ information do help people who read this thread understand why Chanel keeps having price increases 2-3 times a year and the quality is like down the drain!! Also, Chanel is not fully transparent to their consumers which is why I decided to read and research it. Maybe this thread would wake some of the chanel fanatics that there is a change in chanel quality and should be aware of chanel's business decisions that might potentially affect the consumers. Since they are lowering the COGS eg. using lower grade materials/ poor leather coating = faster wear and tear = goods returns or send for repair (to me its quite distressing because I just sent my c19 caramel due to the shoddy workmanship on the front main dangling chain, and the after-sale associate told me to wait up to 6 months?!????) = i lost confidence in the brand and would not buy bags anytime soonYou are just amazing to do this @rainbowneko

So back in 2019, when COVID hit, I know Chanel (or whatever “Chanel” really is) took out a loan for $500m that had all kinds of hair on it, most of it regarding sustainability pledges over the subsequent years.

Not sure bags are scarce tho. Some are limited that’s for sure. But many if not most boutiques are rife with stock. They have basements and hidden closets (not talking about the ones we all rifle through when we go in) with bags even up to a decade old. I think there’s the appearance of scarcity, but not sure it’s backed up with what I’ve seen and heard. I do know they’ve cut way way way back on RTW tho.

I am from Asia so the launch of the new season collection would be around 2-3 weeks later after the launch in US and Europe. Talking about seasonal bags, popular ones would either sell out during the launch day or be put up as not for sale (display only). Since I am not a vip or big spender, generally it would be slightly harder to get seasonal bags through walk-in on launch day. As for classic flaps, I heard there is a waitlist for that so it seems like my country is not well stocked! RTW I can't comment on it because I don't buy RTW!

That really low Cost of Goods stares you in the face. I think back to the newest designed 22 being the "It Bag" and can't help but think the cost of it is 25% of a flap or Gabrielle. If Chanel wanted to design a great carefree everyday bag that lasts, they would have been more clear about its durability in verbiage. But this bag was a no brainer in terms of design and inexpensive materials, why not feature it as the must have bag?

We need to read between the lines. Where is the R and D money going? Maybe into Beauty which is also very subjective/questionable but highly profitable. I recall having a makeup session some years ago and the face cream was $500 plus. I was told it had flowers (camellia's grown on a Swiss hillside, near a convent or some such thing). Come on now..... As I read thru Chanel's latest info, they claim to have designed a beautiful recycled glass bottle. Well thats all well and good but don't sell us beauty products that are nothing more than we can find at Walgreens and charge us $500 just to throw in a recycled glass bottle.

We need to read between the lines. Where is the R and D money going? Maybe into Beauty which is also very subjective/questionable but highly profitable. I recall having a makeup session some years ago and the face cream was $500 plus. I was told it had flowers (camellia's grown on a Swiss hillside, near a convent or some such thing). Come on now..... As I read thru Chanel's latest info, they claim to have designed a beautiful recycled glass bottle. Well thats all well and good but don't sell us beauty products that are nothing more than we can find at Walgreens and charge us $500 just to throw in a recycled glass bottle.

Last edited:

Based on the low COGS, i feel RTW items eg. the iconic tweed jacket should be on the higher end of the COGS..That really low Cost of Goods stares you in the face. I think back to the newest designed 22 being the "It Bag" and can't help but think the cost of it is 25% of a flap or Gabrielle. If Chanel wanted to design a great carefree everyday bag that lasts, they would have been more clear about its durability in verbiage. But this bag was a no brainer in terms of design and inexpensive materials, why not feature it as the must have bag?

We need to read between the lines. Where is the R and D money going? Maybe into Beauty which is also very subjective/questionable but highly profitable. I recall having a makeup session some years ago and the face cream was $500 plus. I was told it had flowers (camellia's grown on a Swiss hillside, near a convent or some such thing). Come on now..... As I read thru Chanel's latest info, they claim to have designed a beautiful recycled glass bottle. Well thats all well and good but don't sell us beauty products that are nothing more than we can find at Walgreens and charge us $500 just to throw in a recycled glass bottle.

I'm not surprised if the new 22 bag COGS is less than 10% or even 5% of their sales price, and a portion of the gross profit goes to heavy marketing

As for R&D wise, I can't comment.

On the other hand, if there are any reformulations of the products, it's likely to cut production costs!

Chanel beauty... not really a fan of it (I prefer dior makeup haha), so i also can't comment on the quality of their products also. I think their latest N1 collection... totally a marketing hype (heavily marketed by social media influencers) to lure innocent consumers to get their hands on the products

I was about to recommend this book - it gives a real insight into branding and the decision making behind current practice. It’s well written and an easy read. Would be very complimentary to this thread as it talks about Coco chanel and the early days.Did anyone on this thread ever read Dana Thomas's book Deluxe: How Luxury Lost Its Luster many years back? In the book she reveals (probably for the first time for many, this was published back in 2007) how many luxury labels were outsourcing production to low-wage countries and finishing the products in Western Europe, using Chinese labor in Italian factories, skimping on materials, and utilizing assembly line production. (She also gave background on the transformation of small ateliers into brands in stables owned by the LVMHs and Kerings of the world.)

One interesting point was that out of the major luxury houses, she singled out Hermes, Louboutin, and Chanel as among the few that were still sticking to honest production methods and high-quality materials. So for a time I felt safe shopping Chanel, until I began to see rumors about their production methods and complaints about defects crop up on tpf maybe some 8 or so years ago. (I also noticed more recently some issues with Louboutin heels.)

My question is, what changed so quickly between 2007, when everything was supposedly fine, and the mid-2010s when complaints began to crop up? Thomas was pretty scathing in her assessments of other fashion houses with quality and production issues, so I assume she was being honest about her assessment of Chanel at the time.

Read and enjoyed it. Learnt a lot.I was about to recommend this book - it gives a real insight into branding and the decision making behind current practice. It’s well written and an easy read. Would be very complimentary to this thread as it talks about Coco chanel and the early days.

Agree with bolded.Based on the low COGS, i feel RTW items eg. the iconic tweed jacket should be on the higher end of the COGS..

I'm not surprised if the new 22 bag COGS is less than 10% or even 5% of their sales price, and a portion of the gross profit goes to heavy marketing

As for R&D wise, I can't comment.

On the other hand, if there are any reformulations of the products, it's likely to cut production costs!

Chanel beauty... not really a fan of it (I prefer dior makeup haha), so i also can't comment on the quality of their products also. I think their latest N1 collection... totally a marketing hype (heavily marketed by social media influencers) to lure innocent consumers to get their hands on the products

Tracey, do you happen to know why they’ve cut back so much in RTW? I ask because I’m a RTW client and it’s really annoying how hard it is to find any given piece, but then we always hear the story of Chanel - a fashion house not a bag house, they don’t value accessories only customers, etc. but at the end of the day they don’t even seem to prioritize the division they say they care most about!You are just amazing to do this @rainbowneko

So back in 2019, when COVID hit, I know Chanel (or whatever “Chanel” really is) took out a loan for $500m that had all kinds of hair on it, most of it regarding sustainability pledges over the subsequent years.

Not sure bags are scarce tho. Some are limited that’s for sure. But many if not most boutiques are rife with stock. They have basements and hidden closets (not talking about the ones we all rifle through when we go in) with bags even up to a decade old. I think there’s the appearance of scarcity, but not sure it’s backed up with what I’ve seen and heard. I do know they’ve cut way way way back on RTW tho.

As for the low COGs, I’m not surprised if this is also in RTW, not just because the cutting back but I’ve noticed recently that there is substantially more synthetic fabrics used in collections (for example a cardigan that should just be cotton or cashmere is now 100% poly)

Also there are too many bags that show up to boutiques damaged as many have said - but things that feel like happened in transit. Like noticeable holes in the leather of a flap etc.

I will say the one place I will likely continue buying Chanel is the shoe category - I do find them really comfortable and well made. That is something I find surprising, but also makes me believe they have to be outsourcing them. I recently purchased lamb leather boots from 22B that have a buttery leather i haven’t seen on a bag or SLG in years. But I think if those are to go, and RTW continues a strange path, I may not interact with Chanel too much in the future.

Adding like Many others - thanks to the amazingly knowledgeable people here breaking down every piece of info. We are so lucky to have you as a resource on this forum!

Register on TPF! This sidebar then disappears and there are less ads!