Thanks for sharing the information which led me to use capitalIQ and factiva to do some research on this company.

I went to capitalIQ and Factiva and check on Chanel..... TRULY SHOCKING!!

omg i always thought Chanel (or other luxury fashion brands) is just a fashion house that focuses on outsourcing, marketing, and distributing products through their various channels. I'm so wrong and probably blinded by it.

what i understood is that there are more than 60 companies based on Factiva.. in addition, there are quite a few M&A activities going on in some of the subsidiaries according to capital IQ.. truly a Venture Capitalist firm hahahaha.

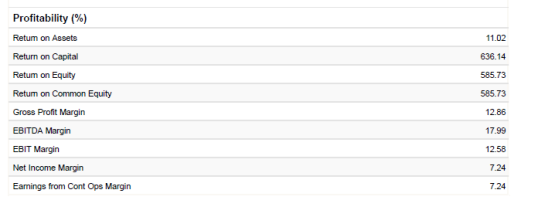

also, i managed to extract the financial statements (up till FY21) in Chanel UK for everyone's reference!!

edit: very smart of Litor Limited for setting up in Cayman Islands... no one knows (or at least in the Internet space) how much revenue or profits they are earning

View attachment 5589097

Nice job! I have access to Capital IQ but it is tiered based & customized based on geo & vertical.

Based on reading what you downloaded, that looks like it’s strictly the UK database, correct?

The point that stands out so prominently to me is the inventory turnover of 24. Seriously??? 24??? That certainly explains the quality deficiency now doesn’t it?

Do you have FactSet? Or preferably a Bloomberg account? It would be interesting to compare.

Regardless, now that Chanel via Mousse has been set up as a DBA of Litor which is hmmmm…set up in the Caymans, well that speaks volumes.

Thank you for delving deeper.

ETA: Your subsequent post that went up as I was writing makes all of us look like sheep now. Thank you for doing the due diligence.

only CapitalIQ (limited settings) and Factiva. But the information provided by both of the websites are quite limited as well.

only CapitalIQ (limited settings) and Factiva. But the information provided by both of the websites are quite limited as well.