You can purchase the item duty free at Heathrow, in which case you will show your international boarding pass at the time of purchase and you will pay for the item less VAT (usually you’ll see a price without VAT, and a price with VAT on the tag at the airport, so you'll pay less than what is shown on the UK website prices. The sales associates will know exactly what to do when you’re there.) You’ll want to be sure the airport shop has what you want first because those stores don’t have everything like the stores in the city. This is the only reason to not to just buy it at Heathrow— if they don’t have it and you have no choice. You can try to contact the store there to check if they have it before your trip is over.

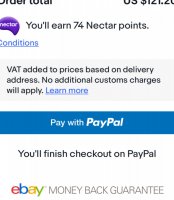

If you buy in London, you’ll be required to show your passport for the purchase at the store, and you’ll pay the full price for the item including VAT. The store will give you paperwork which you’ll take to the airport for the refund, less processing fees (nets to around 12% back I believe). In this scenario you must bring the item un-used to the airport and be prepared to take it out in case you are asked to have it inspected by customs. You’ll get the refund paperwork certified and drop your envelope off for processing into a box, there are locations to do this both prior to check in and after security at Heathrow. It‘s pretty easy, but there is sometimes a short line to get the ppwk certified. Either way, do not put the item in your checked bag as you may be asked to have it inspected again when you land in the US too. Best to put in in a carry on or personal item if you can (you could bring home in just the store bag, but I feel like that gets you searched more often, just a nuisance but not a huge deal.) The net refund (after processing fees) is reimbursed automatically to your card in a few weeks (if you choose that method of refund.) You can avoid this processing fee stuff by buying duty free at the airport and get the full ~20% VAT off, if the item is available there.

When you return to the US, you should declare the value of any items purchase. You are exempt from US taxes on the first $800 per person traveling in your group. If your bf or any one other human is traveling with you, you could claim up to $1600, etc. Any amount above the $800 per person exemption is taxed, but it depends on your location. In LA it is 9% for example, probably the worst you could do in the US. You’ll be responsible for indicating the USD value of items on your claim form when you land. It doesn’t have to be that exact in my experience but do be honest. Once I brought back a $1200 something and the customs officer looked at it and just told me to just to write $800 instead and waived me through. I did not pay any US tax in that instance. If you do end up owing taxes at home, you’ll receive a bill in the mail I think. Again, not a big deal. If you don’t declare the item and they find out, you can forfeit the item and lose your global entry if you have it.

Depending on global pricing and FX rates, it sometimes (usually? Maybe even always?) still makes sense to buy in Europe even if you don’t want to bother with the VAT refund for some reason, depending on sales tax where you live of course. I always keep an eye on the exchange rates too. If for example you can pop by Spain or France real quickly on your trip, the exchange rate of USD to EUR is super right now, to GBP not as great but could be worse and you’ll still come our comfortably ahead vs buying domestically (although I hear Hawaii is cheaper.

)

)

)