Yeah, looks like it depends on the airport and the custom officer. I came back from Asia in July and took direct flight to SFO, the custom officer asked if I had anything to declare. Then in August when I came back from Rome, took transfer flight and went through custom in Atlanta, the officer also asked if I had items to declare. My friend came back from Rome on the same day, took direct flight to SFO, the custom officer did not ask if she has anything to declare.Actually, not quite true. I returned from Europe in May and they were asking passengers if they had any declarations at JFK. The gent in front of me actually had to turn to his wife to ask

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

US Customs discussion - airports, importing

- Thread starter esyee

- Start date

TPF may earn a commission from merchant affiliate

links, including eBay, Amazon, and others

More options

Who Replied?So how do you declare at global entry with that system?Global Entry at LAX has shifted to facial recognition system as well. Walk up to a GE kiosk, it takes your photo, then an officer calls out your name to clear you through.

So how do you declare at global entry with that system?

You tell the officer that you have items to declare. They don’t ask each person that goes through the facial recognition system. Basically, they trust or expect that you will do the right thing and declare.

My daughters, when they had the GE interview done at the airport, was reminded by the officer that they always have to declare.

This is new to me, as I’ve never bought anything overseas and brought it back while traveling. Is it illegal to travel overseas with a worn out or generic bag, buy a new nice back while overseas, throw away the old bag and continue on like nothing happened? Why would you be required to declare something you bought as a replacement? I don’t know the import laws, but it seems to go against common sense to pay an import duty for a replacement bag. I can understand if you bought an additional bag and came back from overseas with 2 bags.

Last edited by a moderator:

This is new to me, as I’ve never bought anything overseas and brought it back while traveling. Is it illegal to travel overseas with a worn out or generic bag, buy a new nice back while overseas, throw away the old bag and continue on like nothing happened? Why would you be required to declare something you bought as a replacement? I don’t know the import laws, but it seems to go against common sense to pay an import duty for a replacement bag. I can understand if you bought an additional bag and came back from overseas with 2 bags.

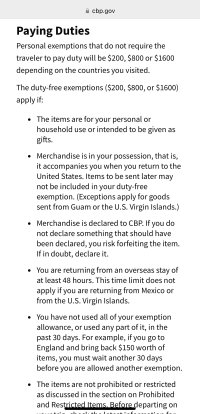

Everything is on cbp.gov.

There are exemptions yes depending on the amount and country visited.

There’s a difference between replacing your old bag with a $200 bag and a more expensive bag (Birkin, Kelly, etc).

Here’s a quick screenshot. You can read more on the website. Hope this helps.

Last edited by a moderator:

This isn't logical at all.This is new to me, as I’ve never bought anything overseas and brought it back while traveling. Is it illegal to travel overseas with a worn out or generic bag, buy a new nice back while overseas, throw away the old bag and continue on like nothing happened? Why would you be required to declare something you bought as a replacement? I don’t know the import laws, but it seems to go against common sense to pay an import duty for a replacement bag. I can understand if you bought an additional bag and came back from overseas with 2 bags.

First of all, if you go overseas with let's say a Baggu, and throw that Baggu out and come home with a new one, that's so far under your $800 exemption that it's a nothingburger, but you are still importing a new Baggu into the US.

If you go overseas with a Baggu, and you toss that out and buy a nice new Birkin (or any bag over $800), you are importing the new Birkin/new bag into the United States above your exemption and therefore pay customs duties on such import.

In addition, if you are coming from a country or region that refunds sales/VAT tax, you will normally have taken this tax refund prior to entering the US. The logic here is that you were refunded tax because you were exporting the bag, so you must pay tax when importing the bag.

It's about import/export, not about your personal collection and how many bags you have.

You are allowed to import used personal goods into the US that were acquired overseas, so, if you want to buy a bag in let's say Paris, keep it there for a year* and use it, then yes, it's a personal effect and can be brought to the US as such without duties. You are not entitled to a tax refund from country of origin in this case.

*there is an actual period of time for this, but I do not recall exactly - believe it is under a year.

Last edited by a moderator:

This is new to me, as I’ve never bought anything overseas and brought it back while traveling. Is it illegal to travel overseas with a worn out or generic bag, buy a new nice back while overseas, throw away the old bag and continue on like nothing happened? Why would you be required to declare something you bought as a replacement? I don’t know the import laws, but it seems to go against common sense to pay an import duty for a replacement bag. I can understand if you bought an additional bag and came back from overseas with 2 bags.

Ha ha ha. Come on now.

Last edited by a moderator:

I'm having the opposite experience with Global Blue vs Planet...I left Paris end of July, still waiting on one big Hermes refund. The Hermes global blue form was rejected by the machine so I had to show French Customs my bags. At the time, two of my purchases had to be shown. One Hermes and the other Chanel. The agent inspected, scanned my forms and said everything was good to go. He handed me back my forms (it was not stamped like in previous years so I’m assuming it is automatic on his end) and I confirmed once again before leaving if everything had been accepted. He said Yes. He also said no need to mail the forms.. It’s been over a month so I check the global blue status today for my Hermes purchase and the online page shows “rejected by customs” !!!!? - my other form for Chanel through Planet Payment has already been processed and refunded so clearly both forms should have gone through. Does anyone know if I’m going to get refunded by Global Blue? I've opened a case online but not sure how long they will take to respond. Freaking out since it’s a very big refundI will co-sign your comment, Global Blue is significantly faster than Planet. I transited through CDG on Sunday and have already received all of my Global Blue refunds. I don’t expect I’ll see the others for weeks, at best, if not a month or two.

Download the Global Blue App and see if your barcode gets accepted. When I had to get my forms stamped by the customs officer, I went back to the kiosk and scanned. It then appeared on my app and I was able to track progress. It took 3 months for the refund of the manually stamped forms, so hang in there.I'm having the opposite experience with Global Blue vs Planet...I left Paris end of July, still waiting on one big Hermes refund. The Hermes global blue form was rejected by the machine so I had to show French Customs my bags. At the time, two of my purchases had to be shown. One Hermes and the other Chanel. The agent inspected, scanned my forms and said everything was good to go. He handed me back my forms (it was not stamped like in previous years so I’m assuming it is automatic on his end) and I confirmed once again before leaving if everything had been accepted. He said Yes. He also said no need to mail the forms.. It’s been over a month so I check the global blue status today for my Hermes purchase and the online page shows “rejected by customs” !!!!? - my other form for Chanel through Planet Payment has already been processed and refunded so clearly both forms should have gone through. Does anyone know if I’m going to get refunded by Global Blue? I've opened a case online but not sure how long they will take to respond. Freaking out since it’s a very big refund

Call Global Blue. Don’t wait too longI'm having the opposite experience with Global Blue vs Planet...I left Paris end of July, still waiting on one big Hermes refund. The Hermes global blue form was rejected by the machine so I had to show French Customs my bags. At the time, two of my purchases had to be shown. One Hermes and the other Chanel. The agent inspected, scanned my forms and said everything was good to go. He handed me back my forms (it was not stamped like in previous years so I’m assuming it is automatic on his end) and I confirmed once again before leaving if everything had been accepted. He said Yes. He also said no need to mail the forms.. It’s been over a month so I check the global blue status today for my Hermes purchase and the online page shows “rejected by customs” !!!!? - my other form for Chanel through Planet Payment has already been processed and refunded so clearly both forms should have gone through. Does anyone know if I’m going to get refunded by Global Blue? I've opened a case online but not sure how long they will take to respond. Freaking out since it’s a very big refund

I left Paris last Thursday. Went to the VAT refund area before checking bags at CDG Had my big H shopping bag and new Kelly with me. Scanned the form at the Pablo Kiosk and got the red x telling me to see the Customs Officer. Nobody was manning the counter. Finally asked a lady who directed people to the kiosks and she said to ring the bell on the far right of the Refund counter. The agent appeared, scanned my form, asked me if I had the item with me and I replied of course and pointed to it. He didn’t ask to see it, but when he handed me back the form, he said to drop it off in the mailbox next to the Pablo kiosk, in the envelope provided. Today, less than 1 week later, my refund came through on my credit card.

Two surprises; the speed of the refund, my refund last April took 20 days and the fact that he had me put it in the mailbox. Even though he scanned it on his end, he didn’t manually stamp it and I thought the need to mail it was a thing of the past. At Gare du Nord in April, they did not require me

to mail it.

Two surprises; the speed of the refund, my refund last April took 20 days and the fact that he had me put it in the mailbox. Even though he scanned it on his end, he didn’t manually stamp it and I thought the need to mail it was a thing of the past. At Gare du Nord in April, they did not require me

to mail it.

I feel stupid for asking but genuinely confused about my experience lately... When I've flown into SFO from overseas, I fill out a customs declaration form - either paper or digitally via kiosk. I flew into SJC for the first time and nowhere did I see the form. I did the Global Entry kiosk and it just scanned my passport, took my photo, and that was it. The customs officer didn't ask me if I had anything to declare, and I thought maybe after baggage claim someone might do this like they sometimes do at SFO but no one did. Did I do something wrong or is this normal? I did buy quite a bit off stuff during my travels so scared it'll look like I didn't declare on purpose??

Okay did a bit more reading up thread and realizing I totally flubbed this by not declaring (accidentally!!!). UGH. I even called the airport's CBP to ask if I can declare or do anything now and he said since I'm already out the door there's nothing else I can do. He did say "don't worry, just do it next time" so not sure if that means I won't get a big penalty or lose my GE? Of course I declare every time I travel for purchases of several thousand but this time I spend much more and get it wrong.I feel stupid for asking but genuinely confused about my experience lately... When I've flown into SFO from overseas, I fill out a customs declaration form - either paper or digitally via kiosk. I flew into SJC for the first time and nowhere did I see the form. I did the Global Entry kiosk and it just scanned my passport, took my photo, and that was it. The customs officer didn't ask me if I had anything to declare, and I thought maybe after baggage claim someone might do this like they sometimes do at SFO but no one did. Did I do something wrong or is this normal? I did buy quite a bit off stuff during my travels so scared it'll look like I didn't declare on purpose??

Did anyone ever not declare (accidentally or not) with duty-free purchases, with GE, and didn't get billed or penalized?

Guys, there is a Global Tax Refund Office in Paris. When you go there with your papers before leaving the country, you get a refund immediately, after that you confirm your departure through a Pablo Kiosk at CDG.

With duty-free airport purchases or with purchases bought overseas and tax refund forms filed?Okay did a bit more reading up thread and realizing I totally flubbed this by not declaring (accidentally!!!). UGH. I even called the airport's CBP to ask if I can declare or do anything now and he said since I'm already out the door there's nothing else I can do. He did say "don't worry, just do it next time" so not sure if that means I won't get a big penalty or lose my GE? Of course I declare every time I travel for purchases of several thousand but this time I spend much more and get it wrong.

Did anyone ever not declare (accidentally or not) with duty-free purchases, with GE, and didn't get billed or penalized?

Honestly I think you'll be fine. You didn't understand the paperless GE and you tried to make it right, plus you have a history of declaring and paying.

Register on TPF! This sidebar then disappears and there are less ads!