Hi all, question for those who’ve flown out of Schipol in Amsterdam. Customs there opens after my departure time so is there another area I can get my VAT return there? Thanks! Edit: woops just realized this is US customs thread. Sorry!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

US Customs discussion - airports, importing

- Thread starter esyee

- Start date

TPF may earn a commission from merchant affiliate

links, including eBay, Amazon, and others

More options

Who Replied?There is a phone and phone number posted for vat help after hoursHi all, question for those who’ve flown out of Schipol in Amsterdam. Customs there opens after my departure time so is there another area I can get my VAT return there? Thanks! Edit: woops just realized this is US customs thread. Sorry!

if you call, someone will come ( after they check that this is your final city before flying home)

if you call, someone will come ( after they check that this is your final city before flying home)also, not sure, but it may be possible to do global blu kiosk in the city

Thank you for letting me know! Since I’ve posted I’ve been able to arrange a Europe visit. It’s all the way in June, but it’s better than zero visits!!I have shipped H leather items from Paris to the US twice (direct from Hermès) and unfortunately both times I was charged 20% duty. There are others here who've only paid 3-9%.

Wonderful! And it will be lovely here in June!Thank you for letting me know! Since I’ve posted I’ve been able to arrange a Europe visit. It’s all the way in June, but it’s better than zero visits!!

Hi,

I will be flying from Rome FCO terminal 1 to Zurich. My flight is at 8:35 am. Looks like the customs office in terminal 1 opens at 8 am and it’s before security. I read that terminal 1 is small with only European flights so I don’t think many people will be claiming refunds so concerned about getting VAT stamping. Do I need to go the previous day and get the form stamped? Any input/advice is appreciated. Thanks!

I will be flying from Rome FCO terminal 1 to Zurich. My flight is at 8:35 am. Looks like the customs office in terminal 1 opens at 8 am and it’s before security. I read that terminal 1 is small with only European flights so I don’t think many people will be claiming refunds so concerned about getting VAT stamping. Do I need to go the previous day and get the form stamped? Any input/advice is appreciated. Thanks!

I don't know where you live, but you need only claim VAT at your final departure.

In other words, if for instance you live in the US, and traveled NY to Rome, then Zurich, then Paris, then return to NY, you only go to VAT in Paris ( your final departure point prior to returning home). You collect all the forms and submit them all in Paris ( as per example). The customs officer will tell you which need to be submitted electronically and which via mail ( many time forms from countries other than the one you depart from need to be mailed).

I don't think the fact that Switzerland is not part of the EU would change any of that, but you can always just go onto the US customs website for all the facts.

Have a great trip!

In other words, if for instance you live in the US, and traveled NY to Rome, then Zurich, then Paris, then return to NY, you only go to VAT in Paris ( your final departure point prior to returning home). You collect all the forms and submit them all in Paris ( as per example). The customs officer will tell you which need to be submitted electronically and which via mail ( many time forms from countries other than the one you depart from need to be mailed).

I don't think the fact that Switzerland is not part of the EU would change any of that, but you can always just go onto the US customs website for all the facts.

Have a great trip!

You are transiting through London, not importing items, so unless staying for several months, you do not need to declare.Hi - I’m traveling to Amsterdam, Dublin, London then back home to the US.

I get my VAT refund stamped at my last EU country (Dublin). But when I enter London, do I need to declare my items or do I only do that once I reach my home country in the US?

Thanks for this info! I live in the US and since Switzerland is not part of the EU I will need to get VAT forms signed in terminal 1 in Rome. I think I will just go the previous evening to make sure I find someone to stamp them in terminal 1. Will post an update here with my experience once I get back.I don't know where you live, but you need only claim VAT at your final departure.

In other words, if for instance you live in the US, and traveled NY to Rome, then Zurich, then Paris, then return to NY, you only go to VAT in Paris ( your final departure point prior to returning home). You collect all the forms and submit them all in Paris ( as per example). The customs officer will tell you which need to be submitted electronically and which via mail ( many time forms from countries other than the one you depart from need to be mailed).

I don't think the fact that Switzerland is not part of the EU would change any of that, but you can always just go onto the US customs website for all the facts.

Have a great trip!

Hi,

Looking for a bit of advice. I recently went to Paris, I got rerouted on the way home due an ice storm on the east coast. I was rerouted to Munich and then put onto a Lufthansa flight into Chicago, where I was supposed to catch a connecting flight. I ended up misconnecting and had to overnight in Chicago and then continued to my final destination in another country as I was never supposed to go the US in the first place. I am American and travel on a US passport and pay US taxes.

I declared my total purchase amount and border patrol directed where to collect my luggage. I then had to search for someone to make payment and I was directed to an area 6 lines deep. On approaching I was intercepted by an officer and asked if I was global entry. I said no and I was told "it's your lucky day we are doing express entry interviews today so you don't have to wait to pay duties and taxes". The lady took my declaration asked if it was the total amount spent and then directed me to hand the form over to the officer at the exit that "I might get a bill in the mail". I guess that they were doing spot checks on global entry and everyone had to get an interview and bag check before departing.

I was stressed trying to catch my connecting flight at the time so I did not think much about it. I had declared the total value of what I bought in Paris but not a list of items. No bill in the mail as of yet. How will they do the bill- from my VAT refund? Normally they go through receipts and determine the amount I have to pay- which varies depending upon the officer.

I have no record that I declared items other than it was on my declaration. I have always paid in the past and I get a receipt demonstrating I paid customs/duties. I am bit worried because I did not get a mail payment request and I am not quite sure how they will calculate the amount due. Has anyone else had this experience?

Looking for a bit of advice. I recently went to Paris, I got rerouted on the way home due an ice storm on the east coast. I was rerouted to Munich and then put onto a Lufthansa flight into Chicago, where I was supposed to catch a connecting flight. I ended up misconnecting and had to overnight in Chicago and then continued to my final destination in another country as I was never supposed to go the US in the first place. I am American and travel on a US passport and pay US taxes.

I declared my total purchase amount and border patrol directed where to collect my luggage. I then had to search for someone to make payment and I was directed to an area 6 lines deep. On approaching I was intercepted by an officer and asked if I was global entry. I said no and I was told "it's your lucky day we are doing express entry interviews today so you don't have to wait to pay duties and taxes". The lady took my declaration asked if it was the total amount spent and then directed me to hand the form over to the officer at the exit that "I might get a bill in the mail". I guess that they were doing spot checks on global entry and everyone had to get an interview and bag check before departing.

I was stressed trying to catch my connecting flight at the time so I did not think much about it. I had declared the total value of what I bought in Paris but not a list of items. No bill in the mail as of yet. How will they do the bill- from my VAT refund? Normally they go through receipts and determine the amount I have to pay- which varies depending upon the officer.

I have no record that I declared items other than it was on my declaration. I have always paid in the past and I get a receipt demonstrating I paid customs/duties. I am bit worried because I did not get a mail payment request and I am not quite sure how they will calculate the amount due. Has anyone else had this experience?

First.. Don’t overthink it. What they sometimes make you pay isn’t too bad. If you declared and you were honest.Hi,

Looking for a bit of advice. I recently went to Paris, I got rerouted on the way home due an ice storm on the east coast. I was rerouted to Munich and then put onto a Lufthansa flight into Chicago, where I was supposed to catch a connecting flight. I ended up misconnecting and had to overnight in Chicago and then continued to my final destination in another country as I was never supposed to go the US in the first place. I am American and travel on a US passport and pay US taxes.

I declared my total purchase amount and border patrol directed where to collect my luggage. I then had to search for someone to make payment and I was directed to an area 6 lines deep. On approaching I was intercepted by an officer and asked if I was global entry. I said no and I was told "it's your lucky day we are doing express entry interviews today so you don't have to wait to pay duties and taxes". The lady took my declaration asked if it was the total amount spent and then directed me to hand the form over to the officer at the exit that "I might get a bill in the mail". I guess that they were doing spot checks on global entry and everyone had to get an interview and bag check before departing.

I was stressed trying to catch my connecting flight at the time so I did not think much about it. I had declared the total value of what I bought in Paris but not a list of items. No bill in the mail as of yet. How will they do the bill- from my VAT refund? Normally they go through receipts and determine the amount I have to pay- which varies depending upon the officer.

I have no record that I declared items other than it was on my declaration. I have always paid in the past and I get a receipt demonstrating I paid customs/duties. I am bit worried because I did not get a mail payment request and I am not quite sure how they will calculate the amount due. Has anyone else had this experience?

Last month my friend declared $35k in purchase and they just waived her through. I have declared $20k in purchases and got a bill in the mail of $175, but they told me a bill was going to be mailed. Based on your post, I don’t even think you will get anything.

Coming back from Greece this summer I declared my purchases and was told that I would be billed by mail. I stressed too and worried about whether it would “red flag” me in the future if it looked like I didn’t pay etc. A couple of months later I did get a bill in the mail for $155.00. Try not to worry about it too much. If they really want to, they will find you. Lol!Hi,

Looking for a bit of advice. I recently went to Paris, I got rerouted on the way home due an ice storm on the east coast. I was rerouted to Munich and then put onto a Lufthansa flight into Chicago, where I was supposed to catch a connecting flight. I ended up misconnecting and had to overnight in Chicago and then continued to my final destination in another country as I was never supposed to go the US in the first place. I am American and travel on a US passport and pay US taxes.

I declared my total purchase amount and border patrol directed where to collect my luggage. I then had to search for someone to make payment and I was directed to an area 6 lines deep. On approaching I was intercepted by an officer and asked if I was global entry. I said no and I was told "it's your lucky day we are doing express entry interviews today so you don't have to wait to pay duties and taxes". The lady took my declaration asked if it was the total amount spent and then directed me to hand the form over to the officer at the exit that "I might get a bill in the mail". I guess that they were doing spot checks on global entry and everyone had to get an interview and bag check before departing.

I was stressed trying to catch my connecting flight at the time so I did not think much about it. I had declared the total value of what I bought in Paris but not a list of items. No bill in the mail as of yet. How will they do the bill- from my VAT refund? Normally they go through receipts and determine the amount I have to pay- which varies depending upon the officer.

I have no record that I declared items other than it was on my declaration. I have always paid in the past and I get a receipt demonstrating I paid customs/duties. I am bit worried because I did not get a mail payment request and I am not quite sure how they will calculate the amount due. Has anyone else had this experience?

Hi,

I will be flying from Rome FCO terminal 1 to Zurich. My flight is at 8:35 am. Looks like the customs office in terminal 1 opens at 8 am and it’s before security. I read that terminal 1 is small with only European flights so I don’t think many people will be claiming refunds so concerned about getting VAT stamping. Do I need to go the previous day and get the form stamped? Any input/advice is appreciated. Thanks!

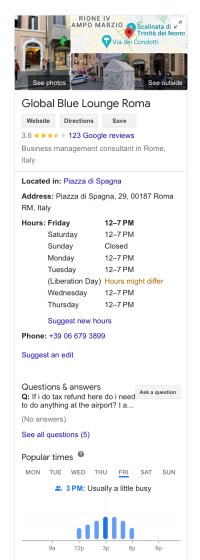

I know there are offices outside the airport too at least for Global Blue not quite sure for other Vat refund services. I have saved time at the airport going into those offices during my trip to get what I can get reviewed and stamped (you need your passport and will need to tell them your departure date). I even got some of my refund before I took off. I think there is a Global Blue office near the Spanish steps.

First.. Don’t overthink it. What they sometimes make you pay isn’t too bad. If you declared and you were honest.

Last month my friend declared $35k in purchase and they just waived her through. I have declared $20k in purchases and got a bill in the mail of $175, but they told me a bill was going to be mailed. Based on your post, I don’t even think you will get anything.

Wow. I must have been unlucky… getting an officer in training and the supervisor. I had to pay $475 for $7500 of declared goods. I was escorted to the payment window.

I'm sorry about your flights- that was one heck of a long way to get home and you must have been exhausted.Hi,

Looking for a bit of advice. I recently went to Paris, I got rerouted on the way home due an ice storm on the east coast. I was rerouted to Munich and then put onto a Lufthansa flight into Chicago, where I was supposed to catch a connecting flight. I ended up misconnecting and had to overnight in Chicago and then continued to my final destination in another country as I was never supposed to go the US in the first place. I am American and travel on a US passport and pay US taxes.

I declared my total purchase amount and border patrol directed where to collect my luggage. I then had to search for someone to make payment and I was directed to an area 6 lines deep. On approaching I was intercepted by an officer and asked if I was global entry. I said no and I was told "it's your lucky day we are doing express entry interviews today so you don't have to wait to pay duties and taxes". The lady took my declaration asked if it was the total amount spent and then directed me to hand the form over to the officer at the exit that "I might get a bill in the mail". I guess that they were doing spot checks on global entry and everyone had to get an interview and bag check before departing.

I was stressed trying to catch my connecting flight at the time so I did not think much about it. I had declared the total value of what I bought in Paris but not a list of items. No bill in the mail as of yet. How will they do the bill- from my VAT refund? Normally they go through receipts and determine the amount I have to pay- which varies depending upon the officer.

I have no record that I declared items other than it was on my declaration. I have always paid in the past and I get a receipt demonstrating I paid customs/duties. I am bit worried because I did not get a mail payment request and I am not quite sure how they will calculate the amount due. Has anyone else had this experience?

I've had about every combination of options- waived through, escorted to window to pay, told " the bill will be in the mail" you name it. I always declare.

When I was told the bill would be mailed to me, I too stressed about it. It finally came after 4-6 weeks, in a plain white envelope, not even an exciting return address. It was in serious danger of being labeled as junk mail and tossed, except we were on such high alert for it, we were opening everything!

This certainly did not red flag me for future trips, and I for one, believe the officer has a HUGE amount of discretion as to what you will pay each time- I've paid less on subsequent trips.

Register on TPF! This sidebar then disappears and there are less ads!