Background:

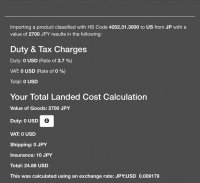

I purchased a preowned item from a Japanese seller. Value of $2,700. Item was manufactured in France.

Seller shipped EMS (to USPS).

Post office carrier brought item to my house and told me I owe $557.49 in duty.

He didn't have any info on how the amount was calculated, all he had was an email with the dollar amount to collect on delivery.

(I did not accept the delivery, at the suggestion of my carrier, he said he would leave a delivery slip stating delivery attempted but no one available to sign for the package. )

I have been googling plus searching the USPS site but cannot find updated info related to how duty is calculated.

Can anyone point me to a site or link to a document that provides guidelines for how duty is calculated?

thanks

I purchased a preowned item from a Japanese seller. Value of $2,700. Item was manufactured in France.

Seller shipped EMS (to USPS).

Post office carrier brought item to my house and told me I owe $557.49 in duty.

He didn't have any info on how the amount was calculated, all he had was an email with the dollar amount to collect on delivery.

(I did not accept the delivery, at the suggestion of my carrier, he said he would leave a delivery slip stating delivery attempted but no one available to sign for the package. )

I have been googling plus searching the USPS site but cannot find updated info related to how duty is calculated.

Can anyone point me to a site or link to a document that provides guidelines for how duty is calculated?

thanks

Last edited: