You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

First Quarter 2024 Revenue Report

- Thread starter A.Ali

- Start date

TPF may earn a commission from merchant affiliate

links, including eBay, Amazon, and others

More options

Who Replied?I agree, overall, spending has slowed down but indeed, if people choose to spend, right now, they spend on certain brands and items only. performing well in q1 is interesting because the global holiday season over and holidays are local events. The comparison to last year's q1 makes sense because in terms of context and events, it is a like for like comparison. Q4 to q1 is more difficult bec the various holidays naturally see more demand, and traditionally q1 tends to be slower overall. They post growth in most locations compared to last year - it is quite a strong indicator of their current strong (superior?) performance.Anyone compare fourth quarter 2023 to first quarter 2024 because to me that’s what’s interesting. That q1 report compared q1 2023 and 2024. When you look at revenues for the Americas there looks to be a sizable drop from last year q4 to q1 this year. China is up but first quarter consisted of lunar new year and singles day. I saw reports that Chinese consumers returned about 70% of luxury items in first quarter. I’m guessing this primarily didn’t include Hermes (why? Probably some of it has to do with fear of losing a qb; perhaps they resell instead!) but it is telling about economic conditions there. If I’m recalling correctly during the press release there was mention that there are economic headwinds that may impact the rest of this year for h. I do think h is benefitting from the very wealthy continuing to spend. I also think most foot traffic is not the super wealthy and the lower end aspirationals while still buying have slowed down their spend. If you look at the beauty category the spend was up there which is what normally happens when the economy isn’t so hot but down in watches. That to me signals a slight slowdown in qb chasers. h bags prices in the second hand market have dropped significantly since their height. In fb reseller groups I am even seeing Lindy bolide tpm etc brand new going for close to retail. I think it’s also interesting that notwithstanding the 8% price increase there was such a drop from q4 to q1. But hey what do I know I’m no economist. And as to impact as a non shareholder I’m interested because a decrease in revenue means lower the demand which means better hopes of grabbing a couple bags I’ve been after off the website. I did notice leather goods revenue was up significantly so the brand must have been really churning out those tpm and herbags this year. The brand is really the it brand rn. The TPM is like the new lv neverfull. Also lower revenue also translates possibly to better service. Sa’s more willing to hunt for something for you. Respond more timely with request or actually respond.

if you go back a few posts I addressed this commentI agree, overall, spending has slowed down but indeed, if people choose to spend, right now, they spend on certain brands and items only. performing well in q1 is interesting because the global holiday season over and holidays are local events. The comparison to last year's q1 makes sense because in terms of context and events, it is a like for like comparison. Q4 to q1 is more difficult bec the various holidays naturally see more demand, and traditionally q1 tends to be slower overall. They post growth in most locations compared to last year - it is quite a strong indicator of their current strong (superior?) performance.

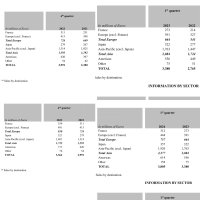

. For Those interested here are q4 to q1 numbers for 2022-2024. Seems like the drop was bigger for the Americas for recent quarters but I’m also not an economist. As for performance. Superior to who? Superior to kering or Lvmh? Yes but looks like miu miu and moncler and brunello cuccineli has strong performances as well. Quiet luxury seems to be having a moment but as others have said when wallets are tight there’s a desire to spend on brands that hold value. But being an it brand also comes with the possibility that it will lose favor due to oversaturation.

. For Those interested here are q4 to q1 numbers for 2022-2024. Seems like the drop was bigger for the Americas for recent quarters but I’m also not an economist. As for performance. Superior to who? Superior to kering or Lvmh? Yes but looks like miu miu and moncler and brunello cuccineli has strong performances as well. Quiet luxury seems to be having a moment but as others have said when wallets are tight there’s a desire to spend on brands that hold value. But being an it brand also comes with the possibility that it will lose favor due to oversaturation.

Register on TPF! This sidebar then disappears and there are less ads!